About

Founded in 2016, Cleo became the first Buy Now, Pay Later (BNPL) provider in Latin America. Since then, it has grown into a leading digital payment company and open banking innovator. Operating across Chile, Mexico, and Peru, Cleo has introduced forward-thinking financial solutions that challenge traditional card-based transactions.

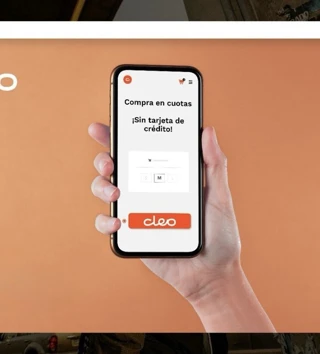

Cleo enables fast, secure, and bank-independent payments directly from a customer's bank account. The service doesn't require registration, and no sensitive personal data is stored. Consumers can complete purchases directly through their bank, while merchants receive funds effortlessly. Behind this simplicity lies an advanced infrastructure with the highest encryption standards and full compliance with modern banking security protocols.

In 2020, as Cleo began to expand its presence in Chile and strengthen its market position, the company sought a reliable technology partner. The goal was to create an advanced checkout system to support installment payments while ensuring speed, scalability, and security. Cleo needed a platform allowing merchants to receive next-day payments while the company managed customer repayments over time — removing risk from the seller's side entirely.

Cleo needed a team that could move fast, build smart, and maintain long-term flexibility. UKAD was selected to bring this exact vision to life. Our proven track record in fintech development, strong industry references, and hands-on expertise with scalable backend architectures made us the right fit.