About

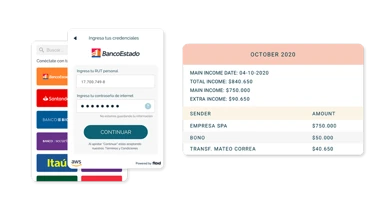

Floid is a revolutionary Fintech startup leveraging the power of Open Finance to transform financial services in Chile. By enabling individuals and businesses to share their financial information with third parties seamlessly, Floid offers a range of services, including frictionless payment initiation, client risk assessment, income verification, bank reconciliation, and comprehensive open banking solutions. The project's founder, hailing from Sweden, chose UKAD for this venture due to our solid reputation in the Swedish market.